AMD has confirmed plans to lay off approximately 1,000 employees, which amounts to about 4% of its global workforce. This strategic cutback aims to facilitate the company’s focus on high-growth opportunities, particularly within the artificial intelligence (AI) sector, where it competes with industry leader NVIDIA. Despite being the second largest producer of chips for AI after NVIDIA, AMD's gaming division has recently seen significant revenue declines, prompting this unexpected move.

According to AMD spokespersons, the layoffs are part of the company's effort to align its resources with its major growth opportunities. This decision follows mixed results from AMD's third-quarter financial report, during which it revealed a staggering 69% year-over-year drop in revenue from its gaming division, plunging to just $462 million. Meanwhile, AMD's offerings in data centers and AI chips are witnessing considerable growth, leading to the decision to concentrate investments there.

"We are taking targeted steps to unfortunately reduce our global workforce by approximately 4%," said the AMD spokesperson. The company has emphasized its commitment to treating affected employees with respect and providing assistance during the transition. The layoffs are expected to target various sectors within the organization, especially those related to gaming and consumer PCs, where AMD has been facing fierce competition and declining market interest.

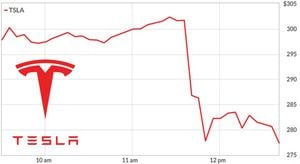

Throughout 2024, AMD has experienced significant fluctuations, as evidenced by its share value. Stocks dropped by 5%, contrasting with NVIDIA's remarkable 200% gain. This substantial disparity is largely attributed to NVIDIA's dominance, holding around 80% of the AI chip market share, which puts immense pressure on AMD's market position.

Although the company has had notable successes—like the popular Ryzen 7 9800X3D—its overall gaming performance seems to have suffered. The revenue associated with AMD's gaming GPUs has declined significantly, leading to speculation about the future viability of its Radeon lineup. The company had initially positioned itself competitively within the gaming sector; nonetheless, its failure to capture gamer interests compared to NVIDIA has harmed its standing. NVIDIA’s advanced offers and established market strategies have resulted in AMD's graphics cards seeing dwindling sales and popularity.

AMD's revenue trends indicate a considerable shift as it reported $3.5 billion from data center sales, up from $1.6 billion the previous year. This stark comparison highlights the company’s pivot toward high-performance data processing chips, aiming to bolster its AI prospects amid declining sales of gaming hardware. Since the gaming sector has historically fueled AMD's growth, these trends showcase the company's necessity to adapt to shifting market demands.

Beyond gaming, AMD is pushing its advances within server and AI chip development, aiming to gain ground against competitors and confirm itself as a serious player within the rapidly growing market anticipated to reach $500 billion by 2028. Analysts project AI chip revenues could witness growth figures soaring as high as 98% by the end of next year, underscoring the urgency of AMD’s strategic shift.

Interestingly, considerable growth within the AI chip market continues, attesting to the increasing reliance on these technologies across industries. Companies using AMD’s MI300X chips, like Meta and Microsoft, recognize the need for alternatives to NVIDIA’s systems, emphasizing the importance of AMD’s move toward becoming more integrated within this pivotal segment.

Despite AMD's attempts to redirect its efforts, challenges consistently loom large. The company has not only struggled against NVIDIA's advancements, but it also sees its own Radeon graphics chips lagging behind NVIDIA’s offerings within consumer hardware surveys. Current data indicates all top ten GPUs are from NVIDIA, with AMD's latest cards lagging significantly behind—pointing to potential issues within its marketing strategy and product reception.

Moving forward, AMD will likely lean heavily on its AI initiatives, with future investment geared toward enhancing its servers and data center capabilities. The company’s CEO, Lisa Su, has previously indicated optimism surrounding AI technology applications as it explores new avenues of growth.

For now, AMD appears set on realigning its workforce as it concentrates on establishing dominance within high-growth segments and mitigating losses from traditional gaming hardware. The transition highlights the broader trend within the tech industry, where many firms are adjusting their strategies to prioritize AI developments over past successes.