The corporate world is abuzz with the recent dispute surrounding the potential acquisition of US Steel by Nippon Steel. Activist investor Anchorage Holdings has taken center stage, advocating for the reversal of this significant agreement.

Reportedly, Anchorage Holdings is preparing to challenge US Steel's executive leadership and board of directors. According to The Wall Street Journal, the investment firm plans to launch a proxy battle to replace nine of the twelve members on US Steel's board. This move is indicative of their deep dissatisfaction with the direction of the acquisition deal and concerns surrounding the management of the company.

Recently, Anchorage expressed its position to its shareholders, asserting there is no need for US Steel to be acquired by another company. They argue disappointment among shareholders highlights the risks associated with entering discussions with Nippon Steel, which is not a domestic entity. Anchorage believes the deal could lead to unfavorable outcomes for US Steel's long-term prospects.

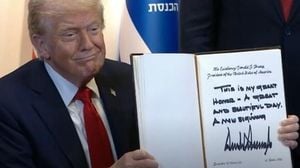

The current situation has been intensified by political and regulatory factors. On January 3, 2023, former President Joe Biden issued orders to ban Nippon Steel's acquisition of US Steel, reflecting concerns about potential foreign control over American steel production. Consequently, US Steel and Nippon Steel have filed litigation to contest Biden's injunction as they seek to push the acquisition forward.

With June 18 approaching, the deadline for Nippon Steel to renounce its acquisition plans looms large. Stakeholders are tense as they await developments from both Anchorage Holdings and the companies involved. Amid mounting pressures, Anchorage has echoed the frustrations of other shareholders, calling for the resignation of US Steel's CEO, David Burritt, who has faced scrutiny over his management decisions.

While Anchorage's activism creates ripples within US Steel's corporate structure, the firm is also considering significant leadership change initiatives. Current reports indicate Anchorage could nominate candidates with experience from similar industries, potentially turning to executives connected to Cleveland-Cliffs, another steel powerhouse.

The impending proxy fight has created anticipation among market watchers. It not only speaks to the influence of activist shareholders but also raises important questions about corporate governance practices within traditional industries particularly as the U.S. steel sector remains under scrutiny for maintaining competitive operations.

Investors have begun to react, with stocks fluctuated as the situation develops, highlighting the market's sensitivity to potential leadership changes, corporate strategies, and investor sentiment. With Anchorage Holdings stepping boldly forward, they aim to reshape the future of US Steel, questioning whether those at the top are steering the company on the right path.

US Steel's future will largely depend on the outcomes of both the proxy battle and the legal challenges currently underway. Anchored by shareholder voice and activist pressure, it remains to be seen how effectively US Steel can navigate these turbulent waters.

Anchorage's actions may not just influence executive decisions but could also steer the direction of future corporate acquisitions and investments within the steel industry. Observers will be watching closely to see how this battle evolves and what it means for stakeholders both within and beyond US Steel.